The easiest way to get out of credit card debt is to download the Paidback app, where you can track your debt payoff progress, get custom AI debt payoff recommendations, connect with a community to support you, and discover sneaky ways to save money on your debt.

Credit card debt can feel absolutely crippling. It can seem like no matter what you do, you’ll never get out of it. If you’ve got credit card debt, you’re in good company. According to Yahoo!, 14 million Americans hold over $ 10,000 in credit card debt. There’s good news. Credit card debt doesn’t have to way you down, and it’s actually not that hard to pay it off. Here is the easiest way to get out of credit card debt.

DOWNLOAD THE PAIDBACK APP.

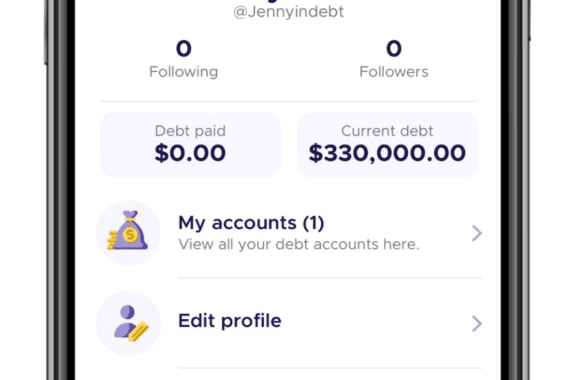

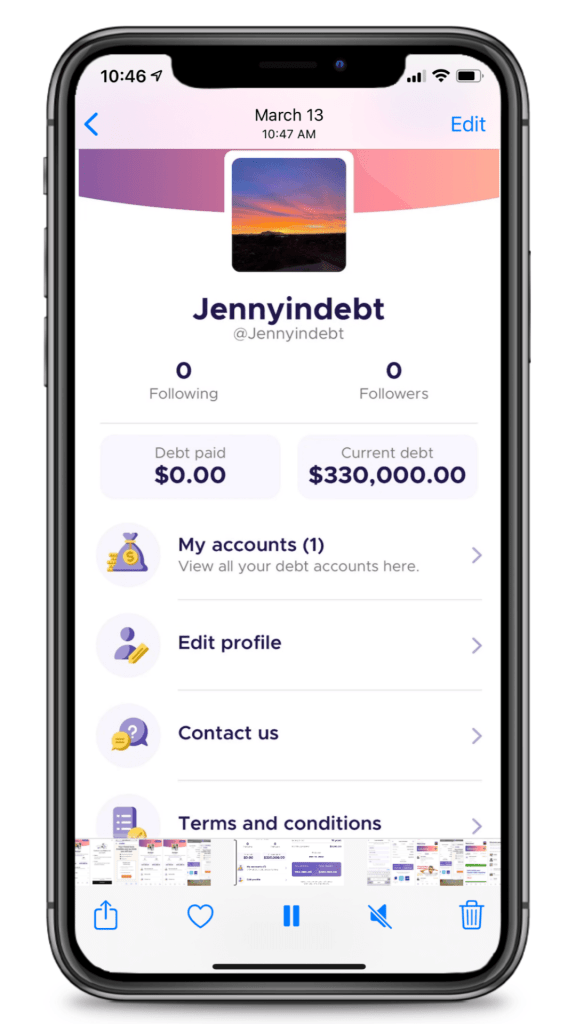

Start by downloading Paidback in the App Store. It’s completely free to download and to use.

TALLY UP YOUR TOTAL CREDIT CARD DEBT.

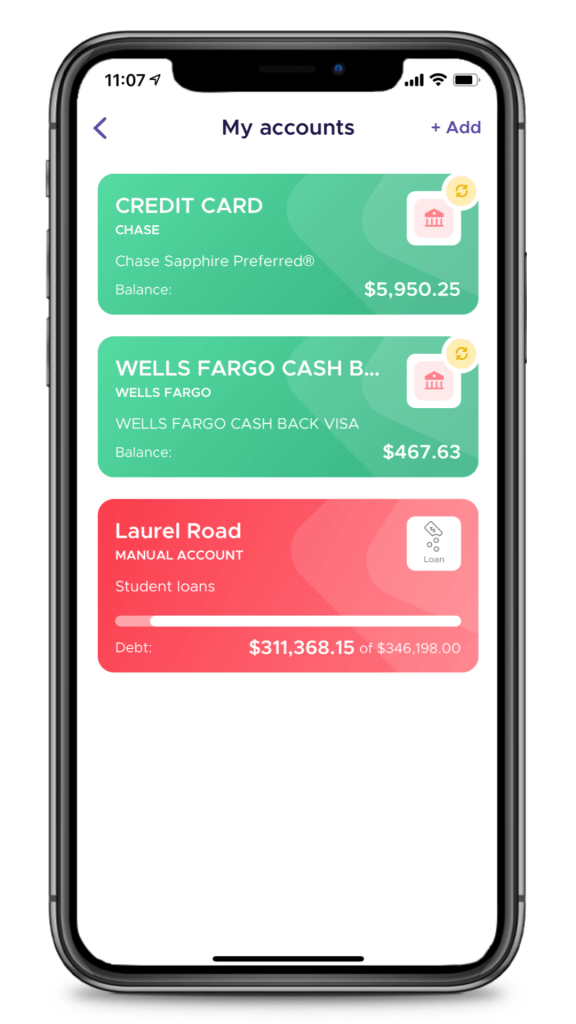

Once you’ve downloaded the app, link each of your debt accounts that you want to pay off. All you do is enter in your online banking credentials. Once you’ve linked them all, you’ll be able to see the total amount of credit card debt that you owe on your profile page as well as under “My Accounts.”

If for whatever reason, you can’t connect your credit card account, you can also enter this information manually.

CHOOSE A CREDIT CARD DEBT REPAYMENT PLAN.

The next thing you should do is choose a method for paying off your credit card debt. Paidback will send you custom debt payoff AI recommendations, such as which debt to pay off first. But in general, I recommend paying off the highest interest debt first because this will save you the most money. This is commonly called the “debt avalanche” method. There are other methods you can try, such as paying off your smaller balances first (commonly called “debt snowball’), but they won’t save you the most amount of money.

If you are interested in learning about the several different methods of paying off debt, you can read about them here: How Do I Pay Off My Debt?

CUT OR SWAP EXPENSES.

Paidback can do a lot for you to make your credit card debt payoff goal easy, but it can’t do everything. One thing you’ll need to do is to cut or swap expenses to reduce your spending. For example, while you’re paying off debt, it might not make sense to stop for a $ 7 latte at your favorite coffee shop each day. Rather than cutting out the coffee entirely, you could swap for a cheaper coffee shop or make it at home. That way you can apply your savings towards your debt.

INCREASE INCOME.

Along those lines, another easy thing you can do to help you pay off credit card debt is to focus on increasing your income. This can be as simple as asking your boss for a raise (assuming that’s warranted based on your job performance) or as complex as changing jobs or career paths. There are also plenty of side hustles you can take on or easy ways to make money from home. [Related: How to Earn Money Without a Job]. When you apply that extra income towards your debt, you’ll be debt free in no time.

MAKE EXTRA PAYMENTS.

Did you know that paying only the minimum on your credit cards, makes it practically impossible to pay off the balance? Paying the minimum also wreaks havoc on your credit score and racks up interest. So making extra payments is key to paying off credit card debt. Once you’ve got extra money in your budget from cutting expenses and increasing your income, be sure to actually apply that extra money towards your debt.

SET UP AUTOMATIC PAYMENTS.

One of the easiest ways to get out of off credit card debt is to set up automatic payments on your credit card. Most credit card companies will allow you to do this in your online banking system. Set up two payments of at least half of your minimum payments (more on this in the next section). That way you’ll literally be paying off debt while you sleep. Set it and forget it! You can also choose to set up automatic extra payments, or you can hop in and make those extra payments manually depending on what your budget allows.

SPLIT YOUR MINIMUM PAYMENT IN HALF AND PAY IT TWICE.

One easy way to squeeze extra payments in is to make a payment on your credit card twice per month. Simply split your minimum payment in half and pay it twice. Credit card interest is based on your average daily balance. In light of that, making smaller, more frequent payments, will save you money on interest and enable you to pay it off even faster.

REFINANCE YOUR DEBT.

Another very easy way to get out of credit card debt is to refinance it for a lower interest rate or opt for a credit card balance transfer with another credit card company. Let’s talk about each of those in turn.

Refinancing.

When you refinance your credit card debt, you typically take on a personal loan with a much lower interest rate to pay off the balances of your credit cards. The average credit card has an interest rate of roughly 16%– personal loans can have interest rates as low as 2.49%. This can save you thousands of dollars in interest and enable you to get out of debt much quicker than by making payments on your credit card.

That said, you’ll need to exercise caution with refinancing your credit card debt because most companies will simply loan you the money to pay off the balances of your credit cards. Meaning, they aren’t actually paying off your credit cards. You’ll need to take that additional step. It can be easy to use the money for spending rather than paying off your debt, and that will wind you up deeper in debt.

Credit card balance transfers.

Getting a balance transfer from a new credit card from your existing ones is also an easy way to get out of debt. Instead of taking on a new loan like refinancing your credit cards. you’ll get a new credit card and your balance(s) from your other card(s) will roll over onto your new card, but with the benefit of a 0% interest rate for a set period of time, usually 12-18 months. If you believe you can pay off the balance within 12-18 months, this is a solid way to save money on your credit card debt. Like refinancing, this option should be used with caution. Because if you aren’t able to pay off your balance during the interest free period, you’ll just wind up in more debt and likely with a higher interest rate than on your original credit card(s).

Getting out of credit card debt is easier than it might seem. Start by downloading Paidback, which is free, and we’ll take it from there.

The post WHAT IS THE EASIEST WAY TO GET OUT OF CREDIT CARD DEBT? appeared first on .